In order to be completely certified with your state in regards to the SR-22 certification, the releasing firm of the certificate have to be accredited within the specific state. Not every insurance provider is able to release the certificate, so it's vital to locate the firm that is able to do so lawfully so that you're able to obtain the certification, have it reported to the DMV and afterwards remain to have the ability to drive on your certificate without concern of remaining in infraction of any type of laws.

Get in touch with your current service provider initially and also then go with a business that is cost effective and also licensed within the state. division of motor vehicles. The DMV in addition to the courts will certainly have the ability to supply you with particular documents as to where you can get the SR-22 in order to remain certified. Furthermore, it's needed to recognize that obtaining the SR-22 needs to consist of contacting your current insurance service provider regarding the certificate.

If you were guaranteed at the time you were needed to have an SR-22, the insurance policy company you were with might cancel your plan with them, depending on your state legislations and also the certain insurance policy company you were with (e.

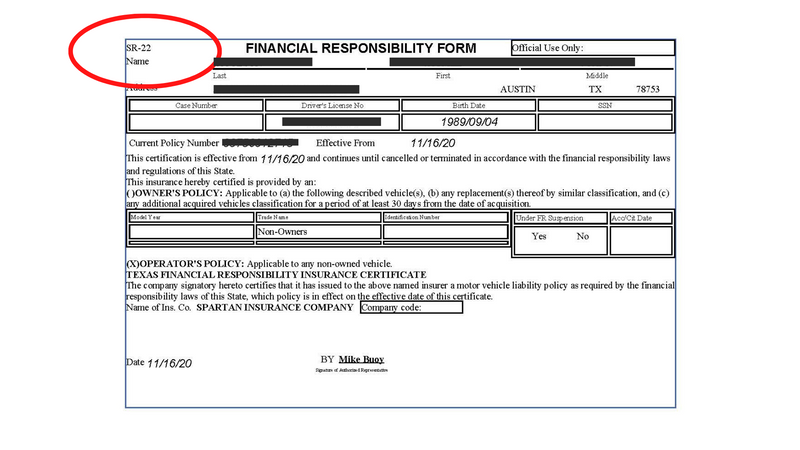

especially true particularly they do not offer SR22 insurance)Insurance coverage Submitting an SR-22 Plan When you obtain the certificate, you will certainly then be able to get the proper policy based upon what the terms of the certificate are.

The smart Trick of Suspended Driver's License? You May Need An Sr-22 - State ... That Nobody is Talking About

The plan in effect with the certificate should satisfy all minimal obligation needs with the state. Every state has their very own obligation demands, so it will differ substantially based upon the regulations of your specific state.

Most states in the nation record suspensions and other concerns on a nationwide computer system. The DMV of a lot of states therefore can not release a license if you have been put on hold in one more state without first obtaining the SR-22 and also having it reported to the DMV (driver's license). This guarantees that your driving privileges are put on hold till you can confirm economic duty.

Please examine the laws in the state you are transferring from, as well as to. vehicle insurance. Particular costs might be examined along with composing the SR-22 certification. Fine charges can get to as high as $250 in some states while reinstatement charges can be $55 or even higher. This remains in enhancement to any court fees as well as the added cost of SR22 automobile insurance policy.

Simply as you can have a driver's certificate without being a car owner, the same holds true of an insurance coverage policy. Oftentimes, despite whether you were a vehicle proprietor at the time of the occurrence or not, obtaining a non-owner SR-22 might be the only manner in which you will certainly be able to renew your driving advantages if your license was suspended.

Various Types of the SR-22 There are commonly 3 types of the SR-22 that can be released by a certain state. It is for that reason crucial to get the appropriate kind after having actually been issued an SR-22 type: This kind of policy will certainly cover the motorist in the procedure of any automobile, also if not owned by the vehicle driver.

Sr-22 And Insurance Information - Department Of Revenue Can Be Fun For Everyone

This kind of policy covers all vehicles had by the vehicle driver. The vehicle needs to either be provided on the SR-22 or be released as "all had vehicles" in order to be compliant. This sort of certificate covers all automobiles owned or un-owned by the driver as well as is for that reason the most comprehensive of the three sorts of SR-22 certificates.

The most common certification is the Operators-Owners Certificate because it guarantees that you are covered regardless of what kind of vehicle you are driving (coverage). This is additionally normally the one to have if you drive a company car at any given time, or can ever before find on your own behind the wheel of a car that is not had by you.

If you are ever drawn over and also can not provide the ideal documentation due to the method your SR-22 certification is worded, you could have your permit suspended once more and have actually lawful procedures submitted versus you for failing to stay within State legislations. Relocating Out-of-State Requirements If you need to move out of the state where your website traffic infraction is and where your SR-22 has been issued, you have to contact the DMV workplace of your brand-new state in order to make sure that you remain in conformity with brand-new state regulation - vehicle insurance.

A Testimony is most frequently called for in order to get the waiver. ignition interlock. Some states will certainly require you to do absolutely nothing while others will certainly require that you receive a brand-new SR-22 based upon their financial duty regulations, relying on whether you carry higher or lower than existing state degrees. The Difference Between the SR-22 & the FR-44 SR22 insurance policy is not to be puzzled with FR44 insurance.

The FR-44 is a certification that is needed in specific instances entailing liquor and/or drugs as well as will certainly raise the minimal liability requirements considerably, hence making insurance policy usually a lot more pricey due to the requirement to have the higher than minimum requirements - insurance. You will understand which sort of certificate you are required to get based upon the state that you live in as well as what the court orders you to obtain.

The Single Strategy To Use For Sr-22 & Insurance: What Is An Sr-22? - Progressive

Final Notes The best means to totally comprehend the details of the SR-22 is to familiarize on your own with state laws. The declaring of the certification will certainly be taken care of in a different way from state to state. The penalty as well as filing costs will differ as will with the certification will really be required. Since all states have various economic obligation regulations, the SR-22 will certainly look extremely various in California than it would certainly in Ohio or another state.

Price contrast site, Vehicle Lending states the price of getting an SR-22, which is between $15 and also $30, much surpasses the economic and also legal threats of not lugging one which can be thousands. Numerous SR22 insurance provider will certainly collaborate with you to get over the troubles that you've had to incur - no-fault insurance.

Ever wonder what is an Sr22? While Sr-22 insurance isn't always a form of insurance individuals want by option, it is a demand by most states to verify that a certain individual has a specific level of auto insurance - bureau of motor vehicles. Usually, it is needed by a judge or court after a person has a crash or obtains a DUI as well as doesn't have the bare minimum of legally needed insurance coverage at the time.

What is Sr22 Auto Insurance Policy? Some insurance policy providers do refer to their SR-22 automobile insurance policy plans as "high danger insurance" for chauffeurs that have had significant crashes with damaged celebrations or a background of driving intoxicated. Sr22 insurance protection handle the fact that the party buying it is a high danger customer as well as usually cares for verifying to the state that they are now effectively guaranteed and also able to obtain on with driving again.

Not to seem judgmental yet after such habits, your standing as an SR-22 vehicle insurance client suggests you are basically an unfavorable component with several insurance service providers. Not all insurance provider will certainly cover SR-22 insurance policy customers. insurance group. What Sr22 Insurance Coverage Does Currently, everybody deserves a second chance to retrieve himself or herself as well as obtaining SR-22 insurance policy coverage is the initial step in the direction of doing that in the eyes of your carrier and the regulation.

Getting The Sr-22 Insurance: What You Need To Know - The Zebra To Work

Is Sr22 Insurance Coverage Forever? After a few years of no accidents or various other significant driving offenses, many people will no more require to file SR-22 forms to their state to verify that they are insured and also will no much longer need to pay the greater costs that are typically connected with Sr22 insurance policy protection (insurance coverage).

Don't consider the limiting nature of SR-22 auto insurance coverage as something you will need to live with forever. Contending least some type of liability vehicle insurance policy protection is needed by most states and if you have been included in some form of accident of incident where you really did not have any type of automobile insurance, you will need to check into buying SR-22 automobile insurance policy coverage because it will automatically file a type with your state verifying that you are covered.

This is, of course, extremely serious and also not something that ought to be neglected. Driving is a benefit and not a right as well as component of having that advantage entails being properly insured. Getting SR-22 automobile insurance will insure that you will be able to appreciate that advantage for years to come no issue what has actually taken place in the past - underinsured.

An SR22 filing is not insurance policy. It's a form that your insurance provider makes use of to verify to the government that they will certainly guarantee you up to the lawfully called for minimal amounts. According to The Equilibrium, judges do not purchase every ticketed motorist to safeguard an SR22. Laws commonly vary by state.

Even if you don't have a vehicle, after the court sentences you for a significant relocating violation such as reckless driving or a DRUNK DRIVING, a lot of states still need you to submit an SR22. If you don't plan on driving up until the state lifts its stipulation, you might be able to drop your coverage. auto insurance.

The Definitive Guide for Financial Responsibility (Sr-22) - Dol.wa.gov

These professionals can help you pick the best coverage based on your scenario. A nonowners plan likewise has specific requirements, such as: You can not possess an automobile.

This kind of SR22 insurance plan is not going to get you street legal. It will obtain you in excellent standing with the state and also provide you insurance coverage if you're ever before in an accident. : You obtain your good friend Steve's automobile, and you cause a severe crash. Steve only has the state's minimum responsibility protection on the automobile, and the damages go beyond those limitations.

Bear in mind, never allow a vehicle insurance policy with an SR22 filing expire. This habit is always a negative idea since your insurance provider is obliged to notify the state when it cancels your plan. This activity will likely lead to a suspended driver's license. If you enable this to take place, you might have to restart your probationary driving condition over again.

HOW MUCH TIME IS AN SR-22 VALID? Each state has its very own requirements for the size of time that an SR-22 have to remain in area. As long as you pay the necessary premium as well as to maintain your plan energetic, the SR-22 will certainly stay effectively up until the demands for your state have been fulfilled (credit score).

WHAT IS THE DIFFERENCE BETWEEN AN SR-22 AND AN FR-44? In the states of Florida and also Virginia, an FR-44 is a "Certification of Financial Obligation". It is similar to an SR-22, however an FR-44 normally requires higher liability limitations. EXIST ANY COSTS FOR DECLARING AN SR-22? The majority of states call for a tiny declaring fee when an SR-22 is very first submitted.

Not known Incorrect Statements About How Long Do You Need Sr22 Insurance In Ohio? - Sapling

At Safe, Car, we recognize that searching for auto insurance coverage can be stressful and costly - insurance group. You can call a specialized Safe, Auto customer support agent at 1-800-SAFEAUTO (1-800-723-3288) to request an SR-22 be submitted.