sr22 insurance deductibles division of motor vehicles underinsured ignition interlock

sr22 insurance deductibles division of motor vehicles underinsured ignition interlock

As soon as you can cancel your SR22 insurance, you might see a decrease in your insurance rates. While your SR22 insurance might expire after a couple of years, your website traffic offense may stay on your document for much longer.

Every vehicle driver requires to obey their state's insurance policy needs per their division of car, even if they do not have a cars and truck. Not having an auto does not enable you to stint insurance policy coverage. By getting non-owner SR22 insurance coverage, you confirm to your state that despite your lack of automobile ownership, you still have insurance and can pay for problems if you cause an accident while driving somebody else's automobile - sr-22.

underinsured insurance companies underinsured underinsured sr22

underinsured insurance companies underinsured underinsured sr22

An SR22 is most frequently needed after having your certificate put on hold because of being convicted of a major website traffic violation like a DRUNK DRIVING (auto insurance). By filing an SR22, you will have the ability to have your chauffeur's license reinstated. Your SR22 follows your driver's certificate because it is a major player in maintaining it energetic for the time being.

We also have an expanding checklist of hassle-free workplace places throughout the nation where you can speak with licensed experienced client treatment representatives concerning any kind of regularly asked concerns or Frequently asked questions you might have. No SR22 Type filing cost! Instant SR-22 filing with the Department of Electric Motor Automobiles! Get your SR-22 Certificate promptly! Do you need even more info on SR22 Insurance coverage Needs as well as car insurance protection? To receive an individualized cars and truck insurance quote, call Insurance Navy today at 888-949-6289. * This item might not be offered in every state, please call among our insurance coverage agents for more details.

The SR-22 plan was created to make it tough for risky drivers to run an automobile without insurance coverage. The Office of the Assistant of State uses the SR-22 insurance certification in Illinois to confirm that a risky chauffeur has the state-required insurance coverage - credit score.

Not known Incorrect Statements About Sr22 Insurance In Minnesota Explained - Policy Advice

After you buy an automobile insurance plan, we file the type to obtain an SR-22 certification that obtains you when driving again legally - sr22 insurance. Without an SR-22 certificate, the Assistant of State withdraws the license of uninsured, high-risk vehicle drivers. SR-22 plans vary from one to 5 years, relying on the nature of the infraction.

That is Required to Carry SR-22 Insurance Policy? Simply put, drivers who have been convicted of significant motor-related violations, including driving without insurance coverage, are called for to carry the Illinois SR-22 insurance policy certification. sr22 coverage. The Assistant of State alerts the individual that he or she has actually been assigned a high-risk chauffeur based on the SR-22 requirement.

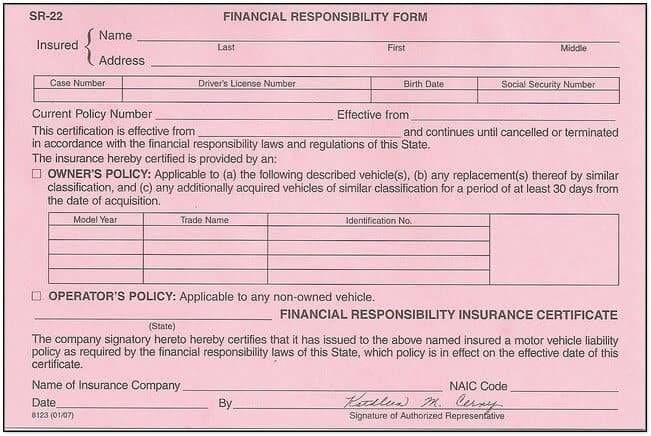

An SR22 is a type released by an insurer that notifies a state that you have the minimum insurance required in that state after obtaining your driving privileges back. It is not insurance policy or insurance coverage, however a means your state guarantees your auto insurance policy is energetic. Secret Takeaways An SR22 is a kind your auto insurance policy business sends to the state so you can abide by court- or state-ordered needs.

SR22s can be submitted with both basic insurance protection policies and non-owner insurance coverage. This file verifies that you have fulfilled your financial obligation for having the minimum obligation insurance coverage.

You'll need to have an SR22 type from your insurance coverage business if your certificate has actually been put on hold or revoked as well as your privileges have actually been renewed. If your insurance policy undertakes any type of considerable changes or terminations, your insurance carrier will alert the state. You might need to keep an SR22 for a collection period, such as 3 years.

Some Ideas on New York Sr-22 Insurance You Need To Know

You call your insurance provider, and also they need to issue you the kind once you have actually bought the minimum amount of vehicle insurance coverage. You'll require to keep the minimum quantity of insurance coverage as well as make certain you have a current SR22 type through established by the state you stay in.

The SR22 can set you back concerning $25 in filing charges. SR22 might lead to a boost in insurance expenses by in between 20% and also 30%. An SR22 released for without insurance driving is around $30 as well as can depend upon your credit report.

If you don't have a car however have to file an SR22 because of a conviction, you'll require to ask your representative concerning a non-owner plan. These policies cover your driving when you drive another person's automobile or a rental and also expense less than insuring a vehicle. deductibles. If you switch insurer while you have an SR22, you'll need to declare a new SR22 prior to the initial plan ends.

This type tells the state about the change. Getting the filing removed may decrease your prices on your insurance. Exactly how Do I Discover if I Still Need SR22 Insurance Coverage? You'll require to call the company that provided the preliminary demand to figure out if the filing is still needed. The company will certainly be either the state DMV or the court system.

In some states, if you cancel your SR22 declaring early, you may be required to reactivate the period over once again, even if you were only a couple of days from the date it was readied to end.

Not known Facts About Sr-22 Auto Insurance

insurance coverage credit score sr-22 insurance driver's license liability insurance

insurance coverage credit score sr-22 insurance driver's license liability insurance

If you're somebody that has recently been convicted of website traffic infractions, consisting of a DRUNK DRIVING, negligent driving, or driving without insurance, it's most likely you're going to call for an SR22. This begs the question, just what is SR22 insurance, as well as what is it made use of for? An SR22 is an exceptionally essential document for those who have a history of driving-related infractions.

It can commonly be gotten along with the automobile insurance coverage you select (ignition interlock). This implies you'll be paying greater insurance policy costs for your automobile than someone without any kind of crashes or violations on their document, and also it will certainly restrict your option in insurance companies.

insure division of motor vehicles driver's license dui deductibles

insure division of motor vehicles driver's license dui deductibles

Actually, SR22s do not elevate the price of your insurance policy. The rise in your insurance policy rates in these circumstances is typically as a result of your sentence, not the SR22. department of motor vehicles. Why is an SR22 Not a Type of Automobile Insurance Policy? You will certainly sometimes listen to an SR22 described as SR22 insurance coverage, which perplexes numerous individuals into assuming it's a specific sort of insurance.

The SR22 is merely a record confirming that your insurance provider warranties you are carrying the correct insurance coverage legitimately mandated by the court to a state's DMV. sr22 coverage. You will have the required vehicle insurance coverage on top of the SR22. The state needs to be incredibly persistent when it concerns regulating which vehicle drivers must not be enabled back out when traveling, especially with offenses such as driving drunk, without insurance coverage, or carelessly to the point of endangerment.

A DUI conviction is an additional cause, as we stated previously. Entering a motor lorry crash while uninsured is likewise a common cause for an SR22. If you are in a crash and you have no coverage, you will certainly not have the ability to properly cover any problems or injuries to the various other chauffeur and also their car.

See This Report on Sr-22 Insurance: What It Is And How To Get It – Forbes Advisor

These factors are added to your vehicle driver's certificate after each significant offense you've had. The DMV and also your car insurance provider will certainly keep an eye on the amount of offenses you have and if you have actually ended up being a liability when driving. If you are described as a constant traffic wrongdoer, you might likewise need the SR22 to get your license reinstated.

While SR22s will get you back when traveling much faster, you must remember it will certainly be expensive. Exactly How You Can Obtain an SR22 You can obtain your SR22 from an insurance provider, but you'll need to purchase the auto insurance coverage first. The purpose of the form is to show that you have actually obtained as well as will certainly preserve certain insurance protection.

The SR-22 declaring would be an important action to your permit back if your driving privileges were withdrawed. To submit the type, initially, take it to your vehicle insurance provider and have them complete their part of the paperwork. Once they have actually done so, purchase at the very least the needed quantity of obligation coverage for the particular amount of time mandated by the state department, which is usually a three-year duration.

This will certainly show that you have insurance protection as well as limitations mandated by regulation. You will receive your own duplicate you can make use of as proof of verification. If required, many states save this electronically in their records so it can be searched for rapidly when needed by the Department of Motor Cars - coverage.

What is SR22 Non-owner Automobile Insurance? When you have an owner-operator certificate, any type of driver operating the car is covered.

The Only Guide to Sr22 Insurance In Chicago, Illinois

driver's license deductibles sr22 coverage sr22 insurance driver's license

driver's license deductibles sr22 coverage sr22 insurance driver's license

What is The Price of SR22 Insurance Coverage? An SR22 can cost drivers a whole lot in terms of insurance coverage prices, but have you ever questioned just how much it would really take to cover a year's well worth? The average expense for an SR22 declaring is regarding $2,760 annually - insure. This is around $230 a month.

While the very best cost is usually around $15, you could be paying as high as $50 for the single charge for declaring, depending on what business submits it as well as the amount of charges are consisted of in the protection you're taking a look at. insurance. The expense of SR22 filings differs and also will usually be much extra costly than a plan without one, according to The ordinary boost in your rates is 89%, but it could range from 31% all the method to 375%.

SR22 Insurance Costs in Different States While you can obtain a rough quote of what SR22s cost, it will be figured out by the state you stay in. This is why it's handy to have a concept of what they cost from one state to another. In Illinois, you have an ordinary insurance policy coverage cost of $1,176, which goes up to $2,217.

You can go online to all states and their expenses when an SR22 is added. Will my Insurance Policy Rates Reduction When I No Longer Have to Lug SR22 Insurance Policy?

For DUI convictions, your rate may never ever return down once again as well as could become worse depending upon various other web traffic violations in the meantime. How much time am I Required to Have an SR22? You would be required to maintain an SR-22 in the majority of states for three years, with the period differing from one to 5 years - driver's license.

The Of Protect Yourself With Sr22 Liability Insurance From Breathe Easy

You need to also know that the start date as well as the Learn more length of time you require to lug an SR-22 varies by state, so it aids to get in touch with the Department of Motor Cars in your certain state to learn when it begins from. no-fault insurance. If you cancel your SR22 insurance before the declaring period is up, you'll be facing fines from the state.